Montauk Fire Department, Ponzi Victim, Gives Back

Two weeks ago, the Montauk Fire Department bookkeeper wrote two checks totaling $81,660 to a court-appointed receiver for the Fire Department’s part in a massive hundred-million dollar Ponzi scheme. The Fire Department did nothing wrong. They had unknowingly been an investor in the scheme, so they were a victim. But then when they got a bit jittery about it, they asked to get out and did, getting their money back with a profit, so they were a winner. But then a court-appointed receiver wanted these winnings “clawed back” since they were “ill gotten gains,” so they were a loser.

And so now the Fire Department has done that, so they are a winner. The money will come out of the Big Bucks account where it was being held, an account where the money from the 22-year-long Big Bucks private charity endowment account for student scholarships is kept. And so there is less money for Montauk kids for college scholarships from that fund, so that is a loser. Though the fire department will make up the shortage from their general fund, so no harm is done and that’s a winner.

Isn’t this something.

Here it is in detail.

In 1983, the people of Montauk opened a bank account to receive money they intended to raise at a Big Bucks raffle held on the third Sunday in September that year. They raised some money. And they have continued to raise money every year since then, putting it into this special account. The interest from this money cannot be spent for any purpose other than the scholarships. By last year the fund was spinning off $32,000 a year, enough to provide 16 Montauk college students $2,000 a school year.

Big Bucks is a big deal, and a good one, all supported by donations from private residents in our community.

Around 2007, an apparently rich man named Brian R. Callahan (I say apparently because the roof subsequently fell in) approached the Fire Department and suggested they invest $600,000 of the account in a fund called Global Advisors. The investment would provide a high rate of return. Callahan and a partner named Adam Manson had by that time working on the restoration of the Panoramic View Resort on Old Montauk Highway. They’d bought the place from the French family for $32 million in 2007, and were spending a lot of money there. The main office was in Old Westbury, a well-to-do North Shore community. And they had lots of other properties they had been buying up.

Seven percent interest was really good spin-off money for the college fund. This was on the up-and-up, right? They gave the good Mr. Callahan the money, and right on time, after the first year, he told them the money had thrown off $32,500, and this made everybody very happy. That was the entire amount that could be sent out to the 16 college kids. The second year it would do the same thing.

Late in the second year, however, the Fire Department began to think this was maybe too good to be true. They had been told that the fund they were in was an offshore account. And so after the second year, they asked to have their investment account shut down and their investment paid out to them.

Callahan had no problem with this. He sent them back $465,000 according to Fire Department Treasurer Dick White—that’s what the $400,000 had turned into in just two years. He was glad to have been able to help.

After receiving the money, the Montauk Fire Department took the whole $465,000 and invested it in a Suffolk County National Bank Annuity fund, something which spun off far less money, but seemed safer. And it most certainly was.

The fire department didn’t know it, but Callahan, to pay them the $465,000, now took in much more than that from other investors who were pleased to be earning such high interest. In the end, Callahan took in nearly $100 million from a total of 67 investors between 2005 and 2012 and, as it happens when you run a Ponzi scheme, they paid off the earlier investors with the money from the later investors and the last people in took a pretty good financial bath when the project collapsed when the financial collapse hit in 2007.

Both Manson and Callahan were arrested in 2013, were taken to trial in 2014, and eventually Callahan pleaded guilty to one count of securities fraud and one count of wire fraud, which could lead to a sentence of up to 30 years in prison, while Manson pleaded guilty to one count of wire fraud and received a sentence of up to five years in prison.

At one point, this reporter went to the Panoramic to see all the renovations they were doing there, which were substantial. I met Manson. And he seemed okay to me. From what I’ve been able to gather, it was his partner who was doing the Ponzi scheme. He came to know about it, though, and did nothing to stop it. He might not even have known exactly what was going on.

You will recall from the news that Bernie Madoff’s $65 billion Ponzi scheme resulted in the appointment of a “receiver” to find all the people who made money with the Ponzi scheme before it collapsed and cause them to pay the court for their ill-gotten gains.

You also might recall that with his money along the way, Madoff had bought a fancy oceanfront house on the Old Montauk Highway in Montauk, something that ultimately got sold at auction after the Ponzi scheme collapsed.

This $100 million Ponzi scheme is really small potatoes when compared to the Madoff scheme—the Madoff receiver has clawed back about $10 billion—but a few bucks here and a few bucks there adds up. Those final investors in Callahan’s scheme lost their money. But the Montauk Fire Department made money, and they were sort of expecting that a receiver would come knocking one day. And so, last week, he did, and so the Montauk Fire Department had its gains clawed back by the receiver, not only the $65,000 profit, according Dick White, but all the interest that profit was earning while in the college fund and then, amazingly, the interest they earned on that money from the annuity investment at the Suffolk County National Bank, White said, all of which totaled an additional $25,000.

Because the interest from this “Big Bucks” account can only be spent for student scholarships, dig deeper at the fundraising party in the third week of September this year in particular.

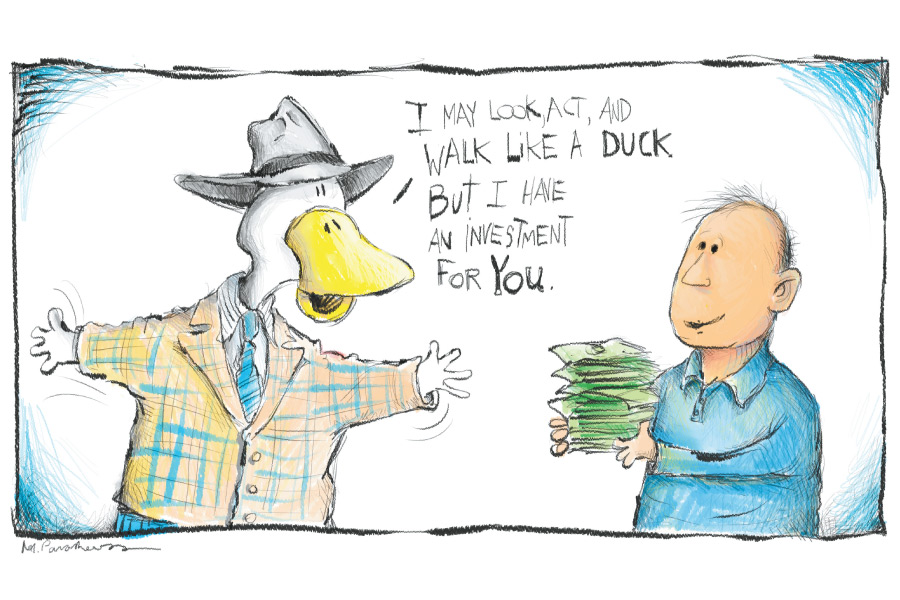

And to the Montauk Fire Department, we say thank you for taking good care of all this scholarship money for the kids, and let this be a lesson to you. If it looks like a duck and tastes like a duck and smells like a duck, it’s probably a duck. So we’re all glad you got out when you did.

And interestingly, this is the second time in ten years the Montauk Fire Department has been in a situation involving some ill-gotten gains. In 2007, Terri Gaines, who was the fire department’s treasurer, was convicted of embezzling $539,000 from the fire department’s general fund between 1999 and 2006. Among the things she purchased with the money was a house in Culloden. She’d paid about $220,000 for it. It was expected in 2006 that it would bring in $532,000 when sold, and so when that happened, she’d make full restitution of what she stole. If she did that, she’d get 1 to 3 years in jail. If she didn’t do that, she’d get 5 to 15 years.

In the end, when the economy tanked, the real estate market tanked and the higher price evaporated. Imagine this. The price of a house would affect how much time a person spends in jail. Eventually, a larger house in Southampton owned by her family got sold to cover the amount. And she served a shorter term, and thus paid her debt to society.