Hand It Over: Western Union Settles $190M Class Action Suit

For the last three years, I have been part of a class action lawsuit against Western Union. The conclusion of this lawsuit occurred last week, and it appears that I will be getting the money back I gave to them as many as 10 years ago, with interest.

It is a fascinating story of corporate greed thwarted and people cheated and it needs to be told.

People send cash from Western Union counters around the country. Here in the Hamptons the locations are in Hampton Bays and Southampton at the Rite Aid pharmacies, and in Bridgehampton at King Kullen (there was also one in East Hampton at Waldbaum’s before that store closed).

I’ve stood in line at these counters. The cash goes to whomever you want to send it. You write their name and the state where they will be picking it up. They show ID or, if they don’t have one, they give a mutually arranged password at a Western Union counter. There’s nothing illegal about it. Money, often hard-earned, can be sent by immigrant laborers to their families back home. It’s sent by locals with family in remote areas where there are no banks, it’s sent to people who are disabled and have no ID to get money other ways. The cash amounts can range from $20 to $4,000, and Western Union charges you about 8% additional for the service. You peel off the cash, give it to the attendant at the counter and get a receipt. And off it goes. It can be picked up later that day.

For about five years between 2005 and 2010, I sent out money in this fashion in amounts of $250 each time to someone near and dear to me who chose to live in a remote area where there are no banks. I could reach him by telephone to see that he received it, but sometimes the telephone connections would not go through. With those, I could only assume it was picked up. Or I could call Western Union and they could tell me whether or not it was waiting to be picked up.

On one occasion in 2010, I came upon a receipt from a transaction I made in 2008 that had a note I’d handwritten on it that said it had not been picked up. I had forgotten about it. So I called Western Union, now two years later, and found out indeed that it had not been picked up.

I was astonished by this. They had held my money for two years. One would think they might have informed me it was still pending. They hadn’t. I could, if I wanted to, go down to the Western Union office now, two years later, and stand in line—I had the receipt—and they would return the money to me. But now it occurred to me that there might be other money of mine they were still holding.

I spoke to a “customer advocate” in Colorado, where they have their headquarters, and asked if he had records of my transactions, and he said they did. He emailed them to me, all 55 of them. I kept meticulous records of the money I sent and the dates I sent it. When the email of my transactions arrived, it was even more astonishing. All I had to do was hold their records and mine, side-by-side.

The transactions that had been sent and received were listed in both records. The transactions that had been sent and not received only appeared in my records. There were three of them. One I had already called about. The other two, from three and four years earlier, were not on this list sent to me.

After calling my “customer advocate” back and being told that’s all he had, I went down to the Western Union office in East Hampton, where I had sent those items, and, after waiting in line, got told, by looking at my receipt numbers, that these two remaining transactions were “still waiting to be picked up.” Behind me in that line at that time were half a dozen blue-collar workers and locals. All of them, it was now clear to me, were giving cash to Western Union at their potential peril. There were probably hundreds of millions of dollars of hard earned cash “still waiting” with this company.

I did two things as a result of this discovery. I went to see State Assemblyman Fred Thiele and showed him these documents, and he helped get a New York State law passed requiring companies that do wireless transactions to return any money to a sender if it is not picked up in 90 days. The company certainly could easily do that. The sender’s name and address are right on the receipt they give out.

The second thing I did was file a claim with the Better Business Bureau (BBB) in Colorado. I believed that their holding the funds of senders and then hiding it was a criminal offense. I wrote that in my claim to the BBB.

In 2011, the roof fell in on Western Union. Out of the blue, I got a letter telling me that some people with the last name of Tennille had filed a class action lawsuit for $200 million against Western Union for these practices and I was among those still owed money. I had picked up the money from the three returns I knew about, but there were still other monies of mine that had not been picked up. My records were meticulous, but not THAT meticulous.

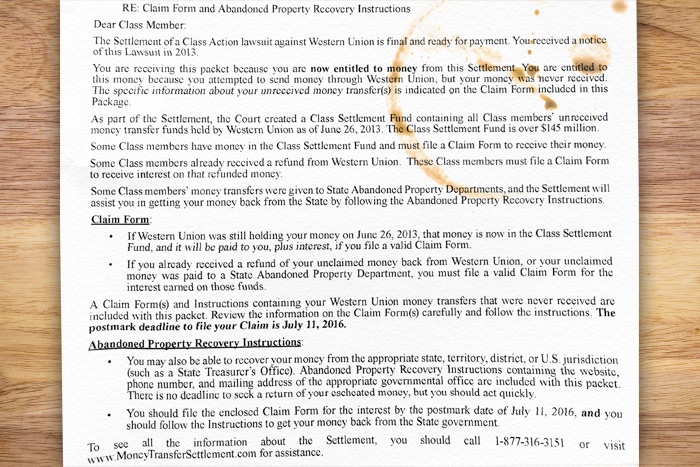

In 2013, I got another letter telling me that a settlement had been arranged, pending an appeal, for about $190 million, set aside to be paid out to those of us still owed money. Legal fees awarded to the lawyers of this lawsuit could not exceed 30% of what was owed. An office was set up, which I could call. A form would be sent to me when all appeals were cleared.

It took three years to adjudicate the appeals. One appeal involved some people in Michigan who wanted triple damages. It was eventually denied. Here’s a quote from an article in Law360 reporting the decision denying that appeal.

“(May 1, 2015, 8:05 PM ET)—The Tenth Circuit on Friday rejected objections to a $133 million settlement between The Western Union Co. and class action plaintiffs accusing the company of keeping money from failed wire transfers for five years despite having senders’ contact information.

“The appellate court said it was not unsympathetic to the arguments raised by two objecting class members claiming the settlement was unfair, particularly the fact that the named plaintiffs have already received refunds, so the unreturned money funding the settlement, which includes $40.57 million in attorneys’ fees, as well as incentive awards, actually belongs to the other class members.”

Last week, three years after this class action began, I received a letter informing me I would be receiving about $850 from two transactions that never got picked up. I just needed to make a copy of my driver’s license or identity card and send in the form to get the money sent.

This letter also informed me that my money would be coming back with interest, and that going forward Western Union would be returning transactions to senders, unasked, if they were not picked up in 30 days. It also said that Western Union admits no wrongdoing.

This has been an incredible journey for me.

However, this case has taken so long that people who are no longer around will never get their money back. I am also still convinced that criminal behavior went on here. The company executives who arranged this policy should be brought to justice.