Moody’s Reaffirms Southampton’s AAA Credit Rating

Following a stellar financial report from Moody’s Investors Service, Southampton Town was able to refinance $13.3 million in outstanding debt to save $725,000 over a 10-year period.

The town’s interest rates were reduced from an average of 3.09 percent to 1.42 percent as a result of its AAA credit rating being reaffirmed by Moody’s for the fourth straight year.

“We timed our borrowing to hit the bond market at a time when interest rates were at their lowest point in recent years,” Town Comptroller Len Marchese said.

At a certain point in the life of a bond, the note becomes “callable,” meaning any remaining debt can be paid off without penalty. The new revenue will be used to pay off existing loans, replacing them with new ones at the now-substantially lower interest rates. The town will see a savings of $110,000 in each of the next three years.

“Our strong financial standing allows us to borrow at very low interest rates, thereby providing significant savings to taxpayers,” Supervisor Jay Schneiderman said.

The town also realized considerably lower rates than anticipated on its current year capital program borrowing, the lowest bidder being Citigroup Global Markets, Inc. at 2.313.percent

Moody’s AAA reaffirmation, the highest rating issued by the investment service, came in its investor report dated May 1. “We continue to budget and to forecast revenues conservatively,” Marchese said. “Moody’s report confirms the value of these sound financial practices.”

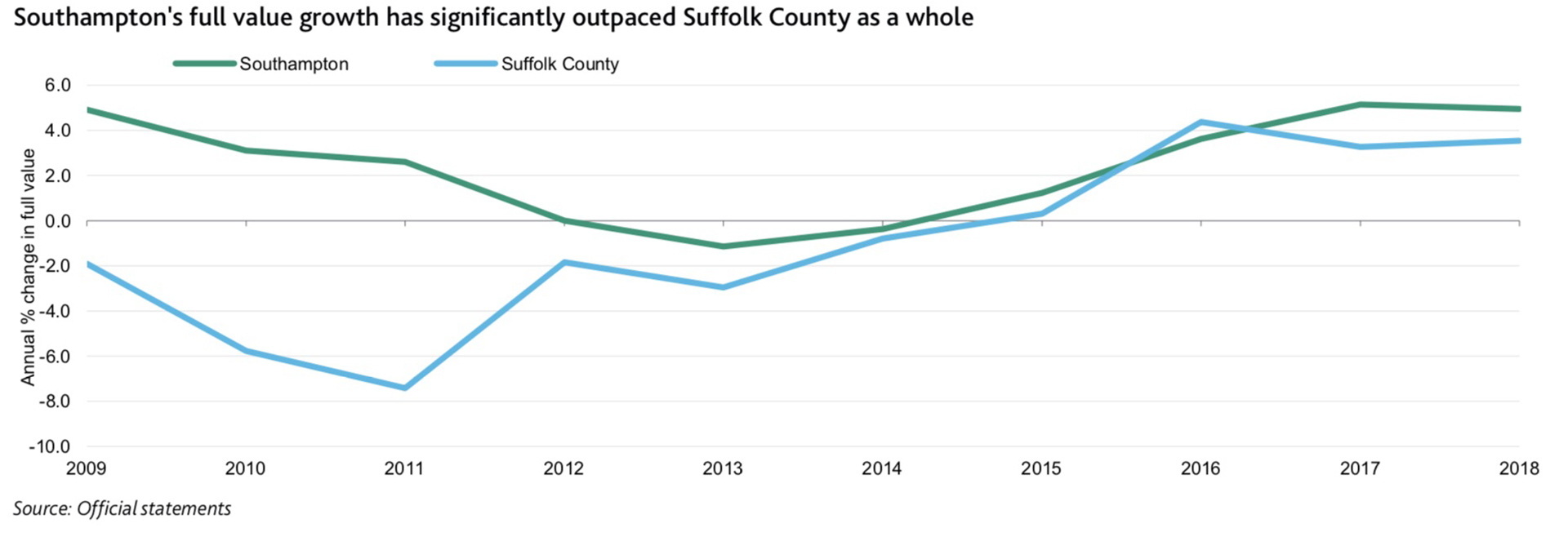

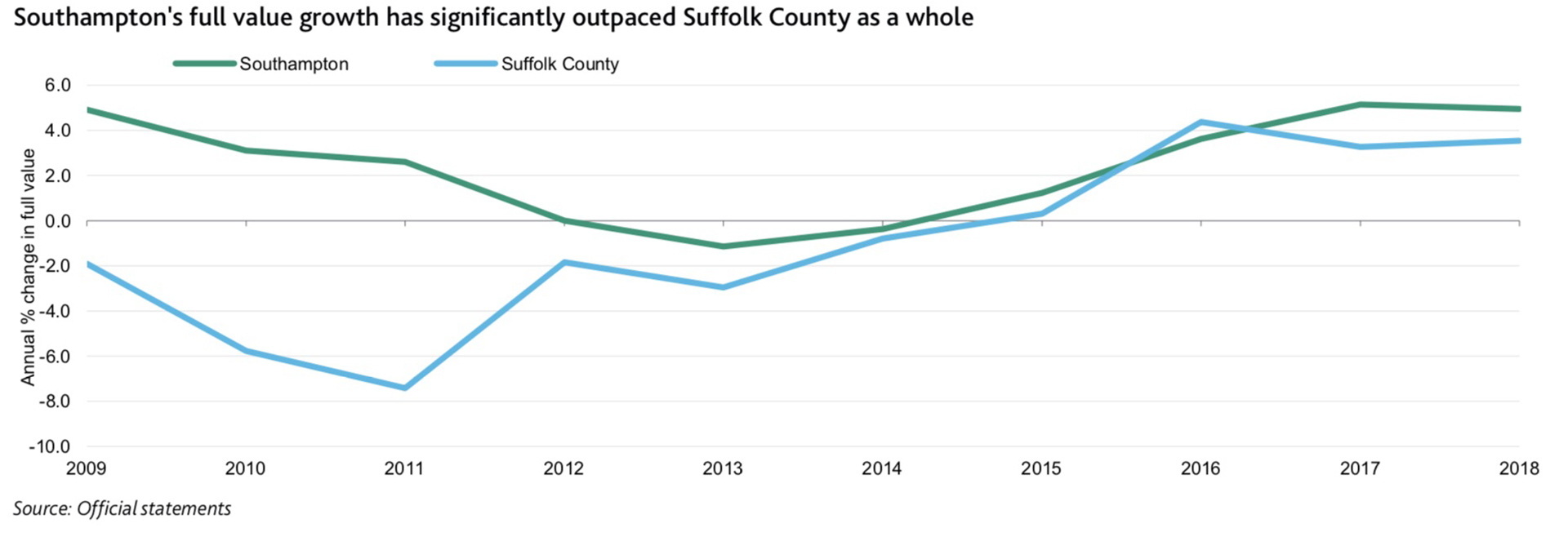

The report noted the town’s large and stable tax base, which continues to grow; there being ample reserves and liquidity; a manageable debt burden; and strong fiscal management. “The stable outlook reflects the expectation that the town will maintain solid financial performance and its tax base will remain extremely large and diverse,” the report stated.

It follows an April 23 presentation led by Schneiderman to the rating agency.

“Moody’s continues to recognize the strong fiscal management and conservative budgeting practices of this administration,” Schneiderman said. “It was a very strong report. It was very favorable with a good, stable outlook. So we’re in good shape.”

desiree@indyeastend.com