Suffolk County Makes Moves to Close 'Cataclysmic' Budget Deficit

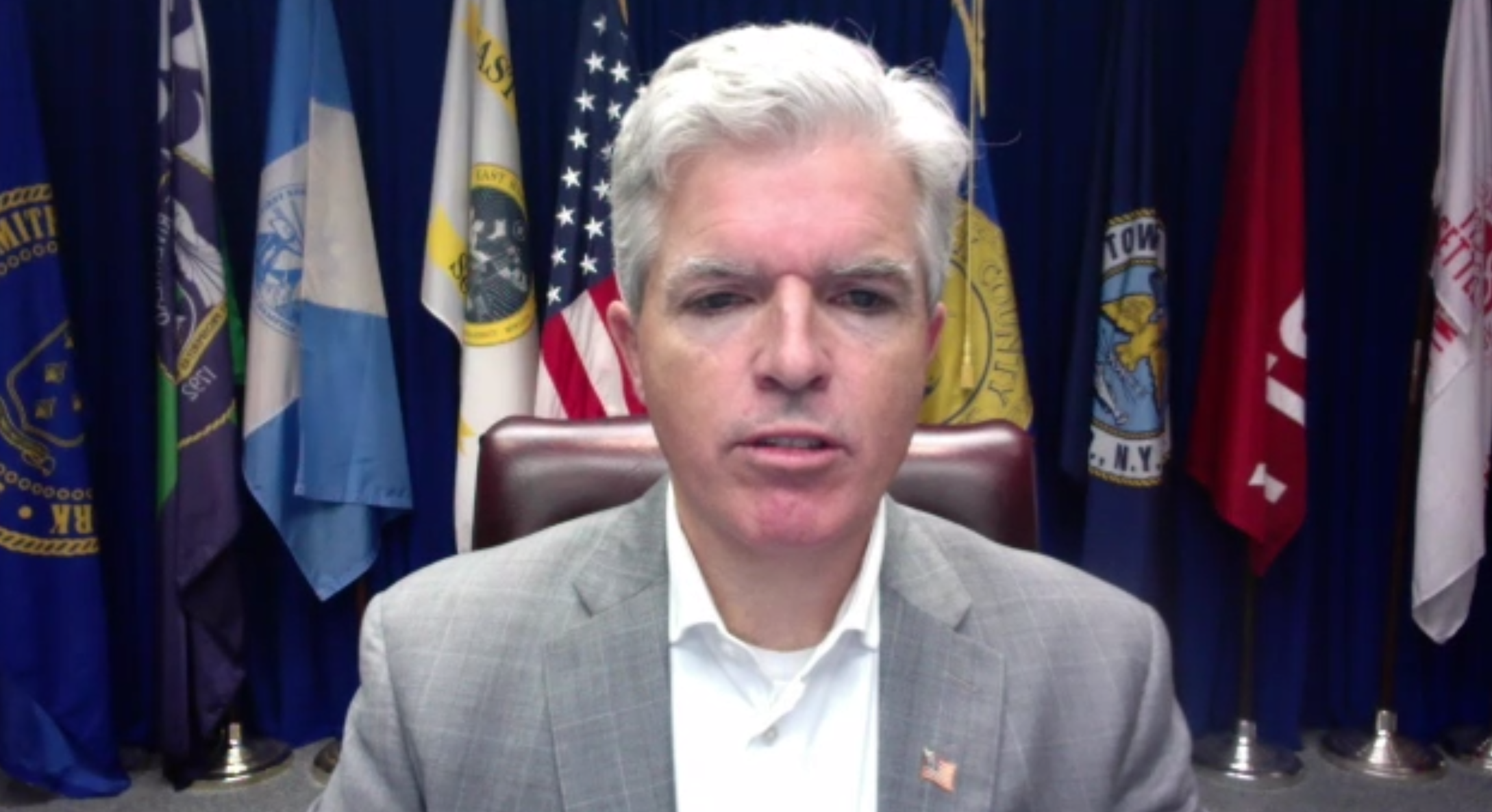

Suffolk County Executive Steve Bellone is taking steps to help close an historic budget shortfall over the next three months during what he called a cataclysmic financial emergency because of the COVID-19 economic shutdown.

A group of independent municipal and finance experts on the COVID-19 Fiscal Impact Task Force looked at the numbers and reported last month that the county is facing a budget hole of up to a $1.5 billion through 2022. In next three months, the best case scenario, Bellone said, is a more than $800 million budget gap.

“These numbers are catastrophic numbers, these are cataclysmic numbers. These numbers are beyond anything we have ever seen before, or could have imagined here in the county,” Bellone said, renewing his call for the federal government “to provide relief to prevent what would be a hallowing out or gutting of this government and its essential services.”

But even with federal relief, “we are going to need to make difficult decisions, difficult choices,” he added.

On Monday, during his daily COVID-19 briefing, Bellone said he would sign an executive order to immediately freeze all steps and raises for management and exempt employees. He is also submitting a resolution to the Suffolk County Legislature that would extend the executive order through 2021, deferring all step increases and raises for the next two years. The move will mean approximately $3.4 million in savings.

“More painful measures” could be on the horizon, Bellone said. The budget office is analyzing additional cuts and looking for recommendations from department heads.

Already the county has embargoed funds, producing $29 million in mitigation, and is looking to utilize several taxpayer protection funds in existence. Two of those funds will require voter approval, but if okay, will help close $75 to $100 million in the budget gap.

Peter Scully, the deputy county executive, held a media briefing later on Monday to go over some of the county executive’s proposals. The first is to use $15 million fund, which is meant to keep sewer taxes at a reasonable level. Scully said it is well-known that it’s well overfunded, and the county would ask to forgo repayment from the general fund. The county would also make sure that there is always an adequate amount of funding so it can meet its stated goal of stabilizing sewer taxes, he said.

The second bill seeks a temporary adjustment in percentages of how the sales tax is divided up between tax stabilization funds, open space preservation, and water quality programs. It would be altered over three years in order to put more toward the tax stabilization with what Scully said would be no negative impacts to the environment.

The Legislature has until July 21 to advance the bills in time for the November ballot.

Eric Naughton, the budget director, presented to the legislature what Scully called “draconian approaches to plug the gap.” They included laying off 200 workers for $21 million in savings, lagging the payroll by one day each pay period to save $28 million, and a $25 million savings by deferring pension payments. The director also suggested lawmakers ask for an increase in the county sales tax rate by a quarter percent and a 1.5 precent rate increase to the home energy tax rate.

Each would have significant impacts, Scully said. Instead, the county executive’s staff have identified two specific ways to repurpose tax stabilization funds.

Bellone said the economic recovery from the coronavirus should not be stretched out over a decade or more. “It is really critically important that the federal government get back together here and focus on getting this necessary relief to the local communities that have been on the front lines of this battle,” he said.

The county is looking for “a fraction of the money we send to Washington,” billions more than the county gets in return, he said, adding that the federal legislators need to deliver for Suffolk County residents.

“It really is unthinkable for the federal government to not respond here,” Bellone said. Tax payers, first responders and essential employees during COVID-19 should not bear the cost. It would be “unconscionable and a terrible mistake.”