Residential Referendum: Voters to Decide Fate of Proposed Community Housing Fund

Should East End localities create a new real estate tax for a Community Housing Fund that would pay for the development of more affordable housing to help alleviate the housing crisis credited with pricing out longtime local residents?

That question is among two that voters in the Hamptons and on the North Fork will find on ballots in the upcoming election that features the gubernatorial race at the top of the ticket. Of the referenda, the proposal to create the Community Housing Fund is the most likely to have the greatest impact on what the region looks like in years to come.

“Towns in my district have enthusiastically embraced this new law and have proven a willingness to tax themselves to generate affordable housing,” said New York State Assemblyman Fred W. Thiele Jr. (D-Sag Harbor), the architect of the proposal. “That is far from the exclusionary or NIMBY intent often ascribed by many to local government.”

Also on ballots — besides races for statewide office, congressional and state legislative seats — will be a proposition asking all Empire State voters if they approve of lawmakers borrowing $4.2 billion to fund the Clean Water, Clean Air and Green Jobs Environmental Bond Act of 2022, a renewal of a state program that funds critical infrastructure projects such as sewage system upgrades.

Here’s a look at both proposals, which will be found on the back of ballots.

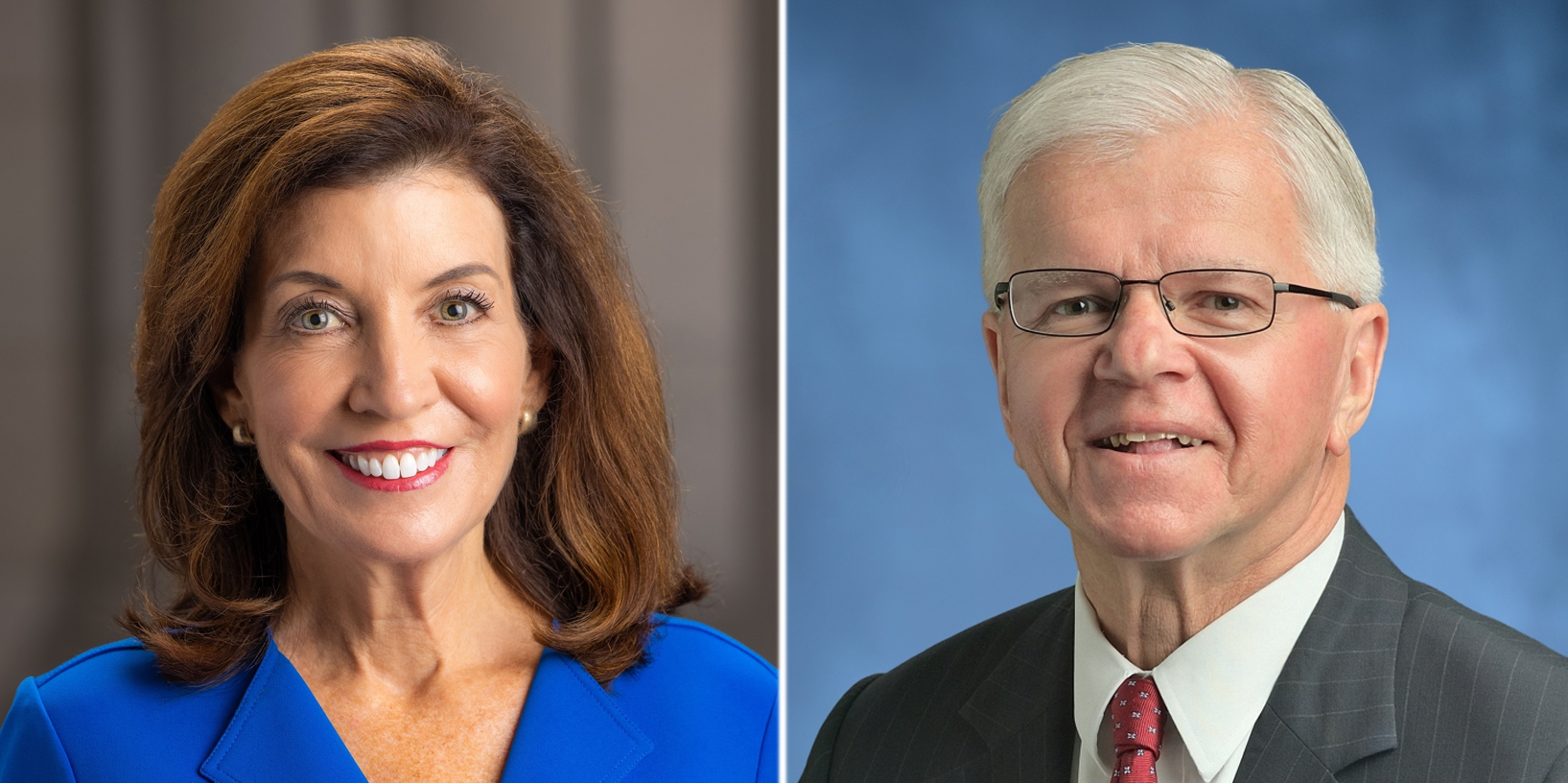

“Make sure you turn over your ballot,” Gov. Kathy Hochul said, emphasizing that votes for candidates will be recorded on one side of the paper ballots and the referenda on the other.

TO TAX OR NOT TO TAX

The boards of all five Twin Forks towns — East Hampton, Southampton, Riverhead, Southold and Shelter Island — have passed measures advancing the 2021 state law creating a 0.5% real estate transfer tax that would fund the creation of a new Community Housing Fund. But voters have the final say if the plan should proceed.

The proposal is modeled after the Peconic Bay Community Preservation Fund, which was created more than 20 years ago, collects money from a 2% real estate transfer tax and has generated $1.95 billion since 1999 — more than $200 million of which came in the 12-month period ending in August.

Towns use CPF revenue to preserve open space. While the COVID-19 pandemic-induced real estate boom fueled record income for the CPF, it also forced up housing prices, making the region more unaffordable for middle-class families, which in turn contributed to an inability of local employers to maintain adequate staffing levels. CHF funds would be aimed at stemming the local Brain Drain, as the phenomenon of talent being priced out of their hometowns is known.

“I think as long as I’ve been involved in government and politics on the East End, affordable housing has been a major issue and the pandemic only exacerbated it and brought it to crisis proportions,” Thiele has said. “It’s very hard for local families. So many want a second home that it’s making it unaffordable for people to buy a first home here.”

The CHF was first proposed in 2002, but the bill did not pass the state Legislature until the housing crisis became exacerbated in the era of coronavirus. It doesn’t only create a fund, like the CPF, the CHF also requires each town to prepare a community housing plan that will outline for the public how the municipality will use the fund.

“Housing is crucial to ensuring that we have people to police our streets, educate our youth, respond to emergencies, and provide services and continuity to our community,” said East Hampton Town Supervisor Peter Van Scoyoc.

Under the 2% CPF tax, the tax is imposed only above $250,000. The new law adds 0.5% for housing. It also increases the exemption to the first $400,000, which applies to the entire 2.5%, according to Thiele.

“The impact of those changes actually reduces the total for all transfers under $1 million,” he said.

FUND FEUD

As for the statewide proposition that voters will also be deciding this election cycle, the The Clean Water, Clean Air and Green Jobs Environmental Bond Act of 2022 is known as the Environmental Bond Act for short.

The proposal would fund projects to address water quality improvement, flood risk management, open space land conservation and climate change mitigation. Critics say the state still has money in the Environmental Bond Act coffers while proponents argue the plan will support more than 100,000 jobs.

“Critically important to make those investments now, because yes, it is a big price. The longer we wait, the numbers just go up,” Hochul said. “They just keep going up. And that is why it would’ve been better if this had been done in the past, we’re doing it now.”

Conservatives argue that voters should reject the borrowing since billions in federal funding is likely coming to the Empire State from the $2 trillion Build Back Better spending package passed earlier this year.

“We fear New York State’s reputation for unchecked spending will result in the possibility of the state legislature spending the entirety of the $4.2 billion on projects that should be paid with existing authorized debt, new federal sources, and pay as you go where possible,” said New York State Conservative Party Chairman Gerard Kassar.

Union leaders joined environmentalists and Democratic lawmakers in calling on voters to pass the bond act.

Long Island Contractors Association Executive Director Marc Herbst said, “These investments are good for the economy, the people of Long Island and New York at large.”

The 10-day early voting period runs from October 29 to November 6 ahead of Election Day on November 8. To find polling places, call the Suffolk County Board of Elections at 631-852-4500.

-With Taylor K. Vecsey